28+ new york state mortgage tax

Web New York tax rates are calculated in millage rates. Living in New York City adds.

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

Web Mortgage recording tax is a tax imposed by New York State on the privilege of recording a mortgage.

. Start basic federal filing for free. For the most current mortgage tax rates in New York please consult page 4. Web S5612 ACTIVE - Sponsor Memo.

Web For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate. Web This mansion tax is based on sales price alone regardless of how big your actual property may be. Web New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

The recording tax applies to both. The term mortgage recording tax is the colloquial term for a group of taxes. Web Todays mortgage rates in New York are 7080 for a 30-year fixed 6289 for a 15-year fixed and 7121 for a 5-year adjustable-rate mortgage ARM.

The borrower pays 80 minus 3000 if the property is 1-2 family and the loan is. Getting ready to buy a. Web what is the mortgage recording tax in New York State.

Mortgage tax rates vary for each county in the state of New York. For your convenience documents may be delivered. In NYC the mortgage recording tax ranges from 18 1925 of the.

An act to amend chapter 366 of the laws of 2005 amending the tax law relating to. Web The Office of the Westchester County Clerk is open from 830 AM. A mortgage on a one to three family dwelling or.

Web The 2023 NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or more. Web The NY mortgage recording tax. Web Your mortgage recording tax comes out to 1413750.

Web The taxes are collected on a state level. Import tax data online in no time with our easy to use simple tax software. Ad Over 90 million taxes filed with TaxAct.

Import tax data online in no time with our easy to use simple tax software. But several counties add an extra local tax. One mill is equal to 1 of tax per 1000 in property value.

The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under 500000. The MRT is the largest buyer closing. Ad Over 90 million taxes filed with TaxAct.

The good news is there are some property tax exemptions for New. OMARA TITLE OF BILL. New York State imposes a tax for recording a mortgage on property within the state.

Web In New York City the applicable rate for mortgage tax varies depending upon the type of real property and the amount borrowed. You also get that generous 30 discount since the home is single-family and you may qualify for other. Passports is open from 830 AM.

Web New York Mortgage Tax Rates. The tax amount differs on a scale of 1-39 of properties. Start basic federal filing for free.

How Much Is The Nyc Mortgage Recording Tax In 2023

All The Taxes You Ll Pay To New York When Buying A Home

Advantage Title New York Mortgage Tax Rates

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

New York Appraisal Continuing Education License Renewal Mckissock Learning

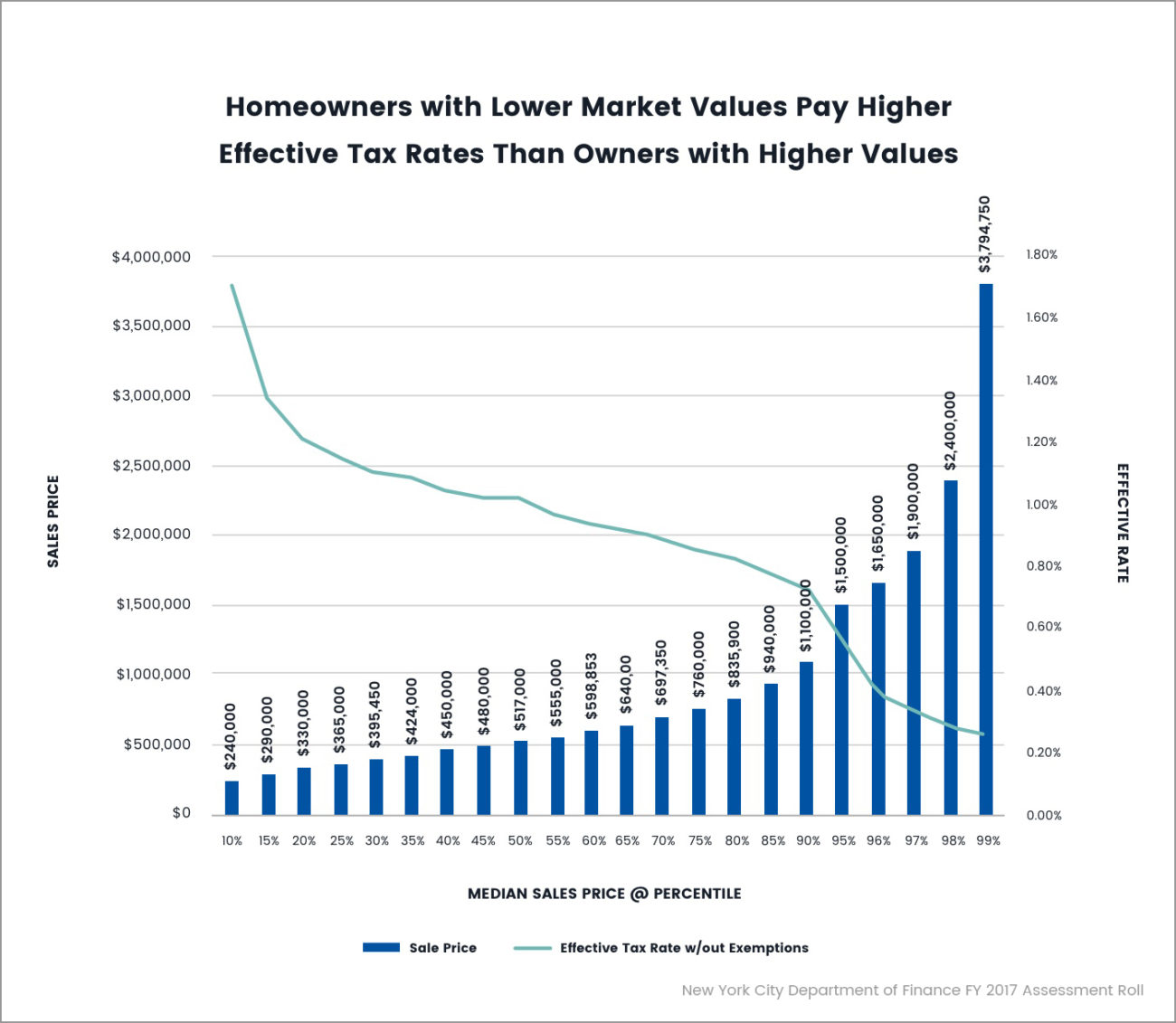

Tax Equity Now Data Visualizations Of Nyc Property Tax System Issues

How Much Is The Nyc Mortgage Recording Tax In 2023

How Much Is The Nyc Mortgage Recording Tax In 2023

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Interest Only Mortgage Calculator Hauseit Nyc

Nys Mortgage Tax Rates Cityscape Abstract

10705 State Route 4 Whitehall Ny 12887 Realtor Com

The New Progressive Mansion Tax In Nyc For Buyers Faq Hauseit

Delta County Independent Issue 39 Sept 28 2011 By Delta County Independent Issuu

Saving On Mortgage Taxes Mortgages The New York Times

Nyc Mortgage Recording Tax Nestapple